Deliver as a cyber trusted advisor

Strengthen and monitor a client’s security posture to prevent or address issues before they lead to costly incidents

Speak the languages of insurance and cyber risk fluently

Insureds deal with a complex and dynamic risk environment, lack of in-house expertise, regulatory pressure, and other challenges. Insurance brokers differentiate themselves and earn customer loyalty with personalized service that enables insureds to make informed decisions, protect their assets, and minimize financial losses. With SecurityScorecard, brokers excel with their ability to deliver risk management advice by tapping into a wealth of security insights and support from experienced cyber experts.

A View Inside

A look inside the product

Outcomes

Cyber risk does not wait for renewal

-

Increase client satisfaction

Deliver experiences that are informative, relevant, and actionable, especially in response to challenging claims situations

-

Differentiate your broking business

Go beyond transactional services during underwriting and renewal and position your brokerage as an extension to the insured’s risk management team

-

Excel in claims advocacy

Maintain visibility of client security incidents and take action to ensure claims don’t get denied

Critical Capabilities

-

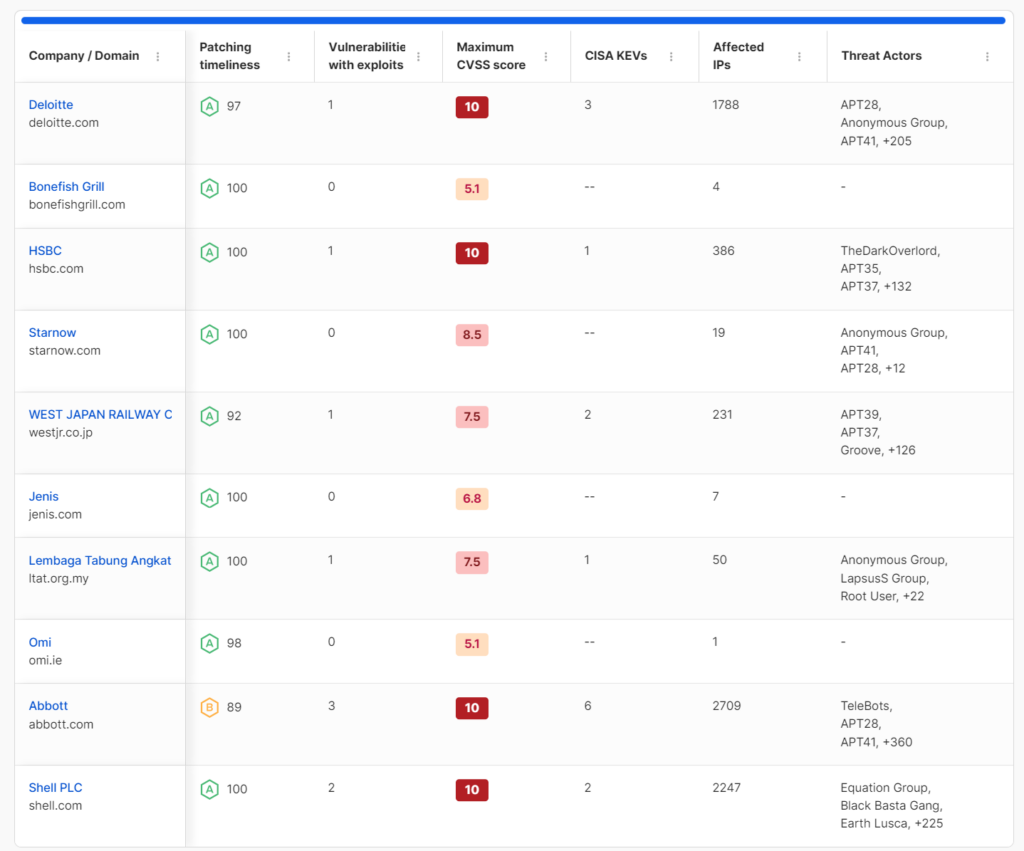

Continuous risk monitoring

Real-time data keeps you informed of new issues that could impact a client’s insurability

-

AI-powered workflows

Data correlated with claims prioritizes areas of focus, enables automation, and drives action

-

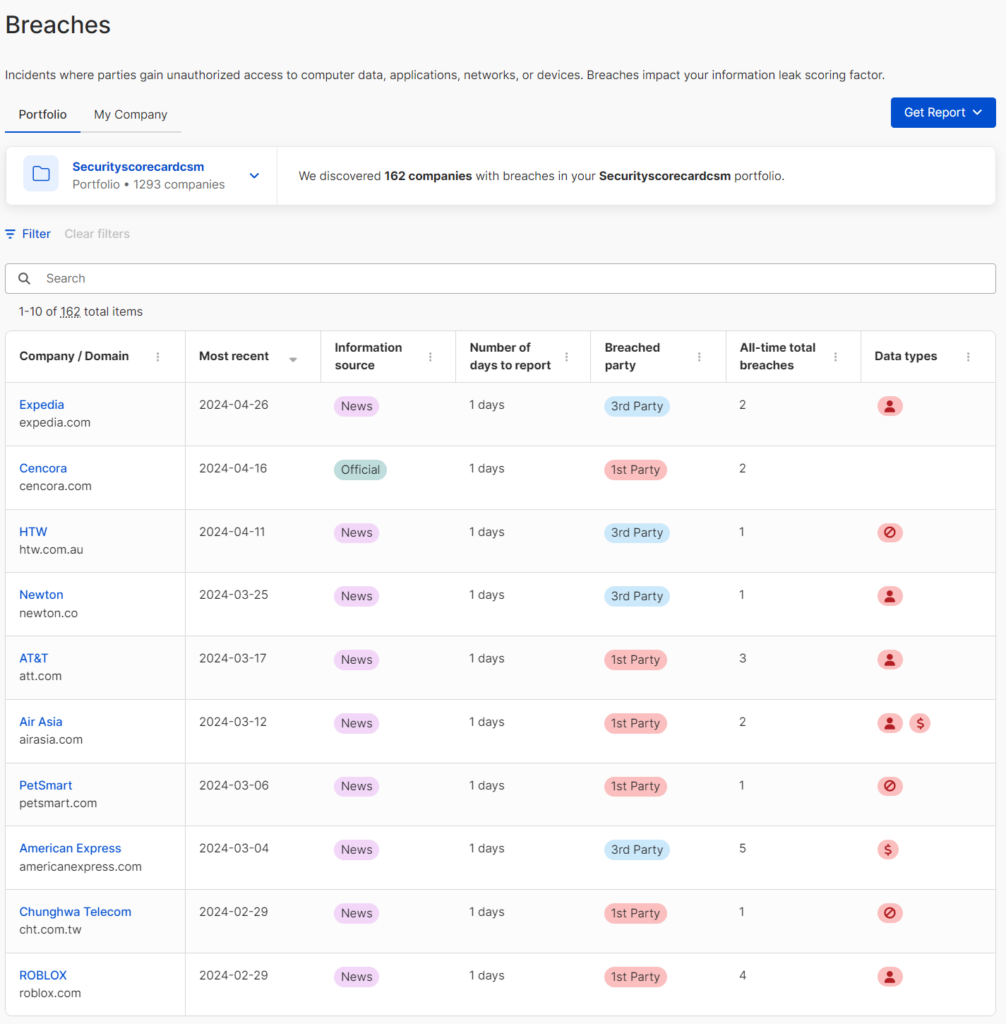

Rapid breach detection

AI-driven reconnaissance informs you of breaches as soon as they are publicly reported

-

Expert resilience services

Partner with cyber experts to defend, respond, and fortify your client’s security program