Guide clients in their cyber insurance journey

Prepare clients for underwriting and deliver optimal pricing and coverage

Understand what the underwriter knows and clear the way for insurance placement

Underwriters judge applicants through lenses bigger than what is attested to in cyber insurance applications. They supplement application responses with data they independently gather about the insured’s attack surface and security controls. Leading brokers understand the drivers of risk and work with clients months ahead of underwriting. SecurityScorecard provides the insights needed to improve a client’s insurability, successfully place insurance, and renew with confidence.

A View Inside

A look inside the product

Outcomes

Earn your commissions and client trust

-

Grow your book of business

Deliver highly insurable clients who consistently will get approved for and renewed for cyber insurance coverage

-

Increase customer satisfaction

Reduce the risk of costly breaches and deliver savings on cyber insurance premiums

-

Create broking efficiencies

Simplify underwriter and client communications and proactively resolve subjectivities using actionable cyber risk metrics

Critical Capabilities

-

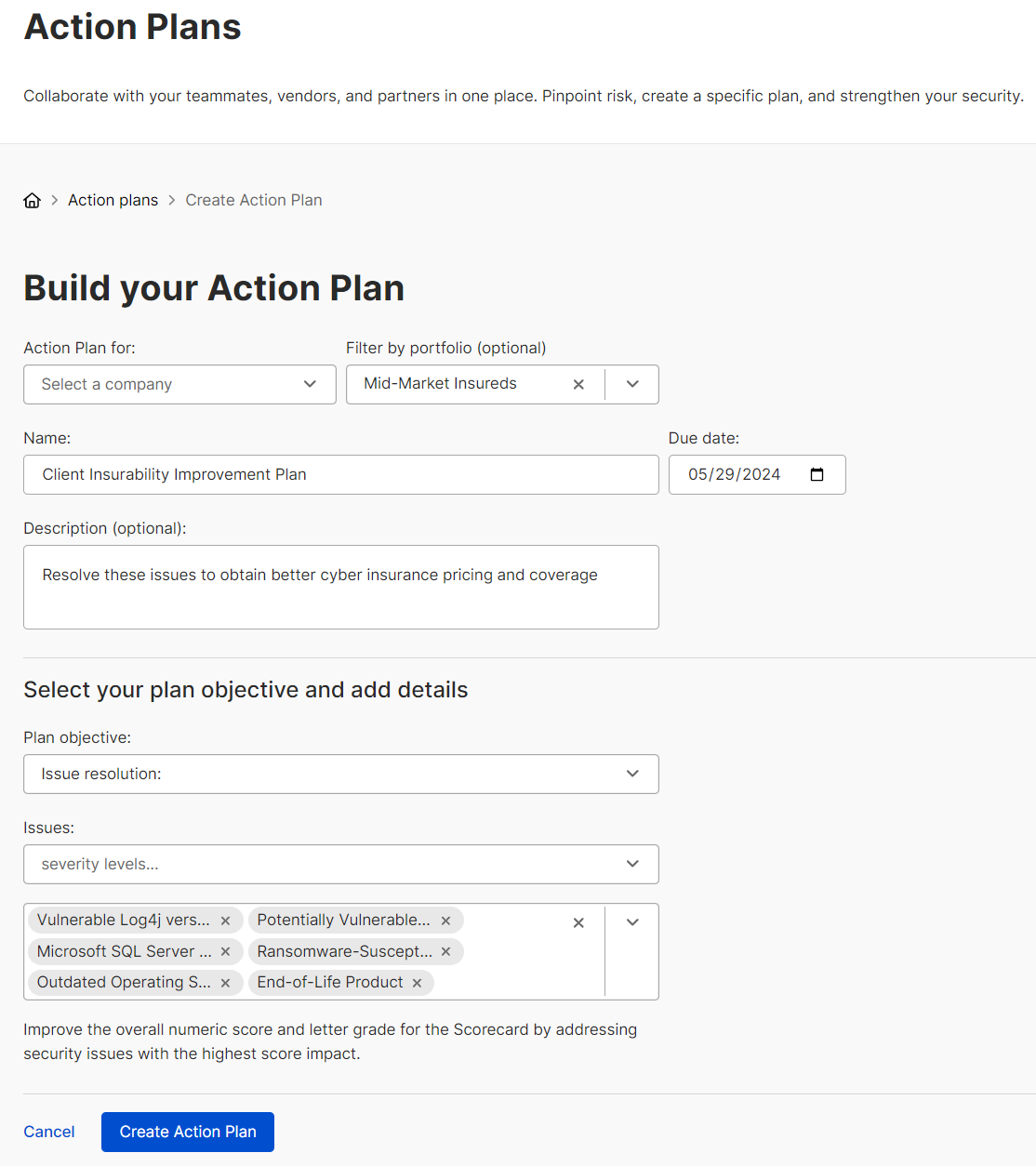

AI-powered workflows

Data correlated with claims prioritizes areas of focus, enables automation, and drives action

-

Common risk management platform

Shared space for all stakeholders to stay aligned on progress and blockers that need resolving

-

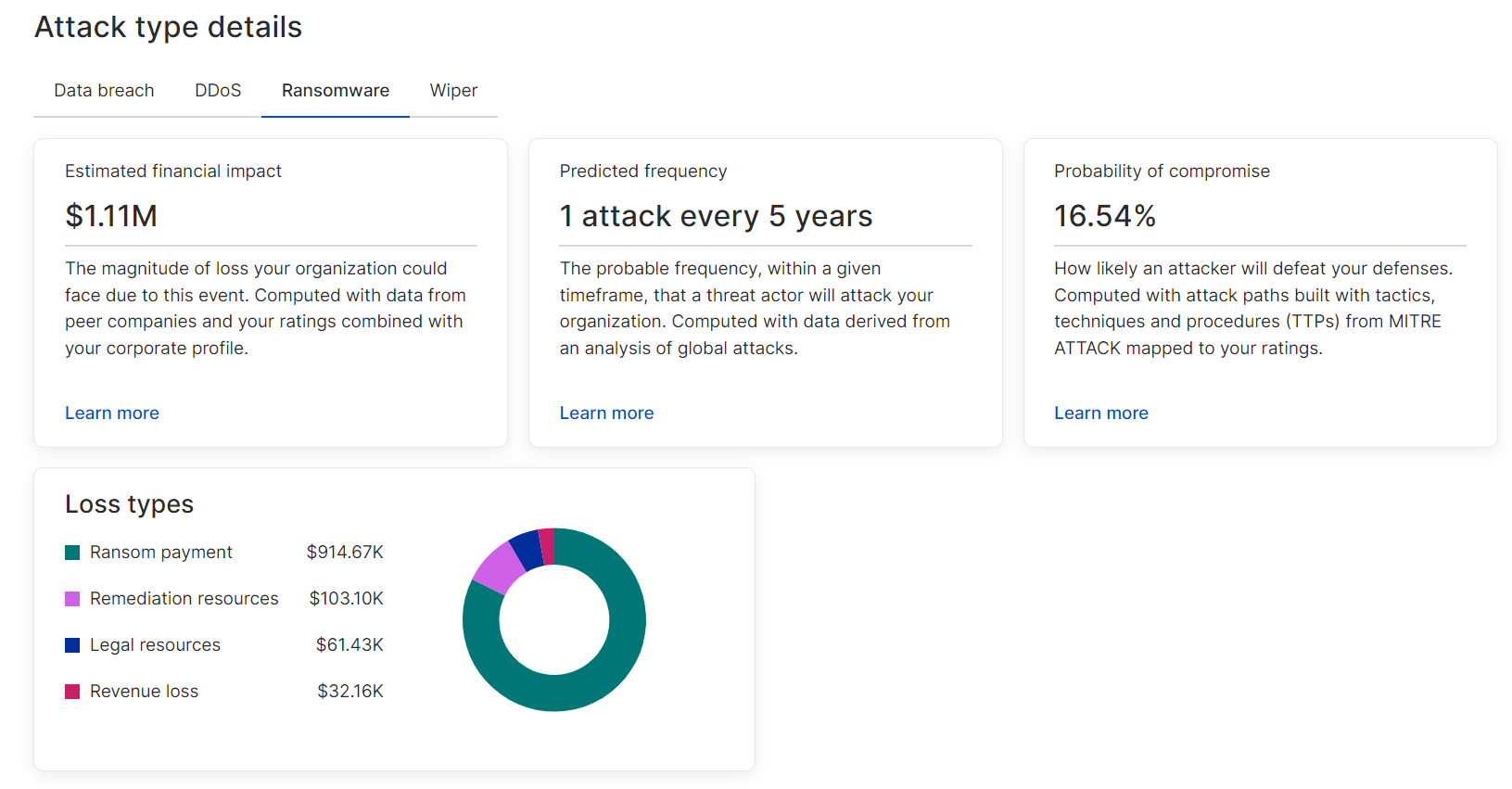

Attack surface visibility

Accurate view of an insured’s attack surface, indicators of compromise, and threat actors’ activity

-

Continuous risk monitoring

Real-time data keeps you informed of new issues that can become an obstacle to renewals