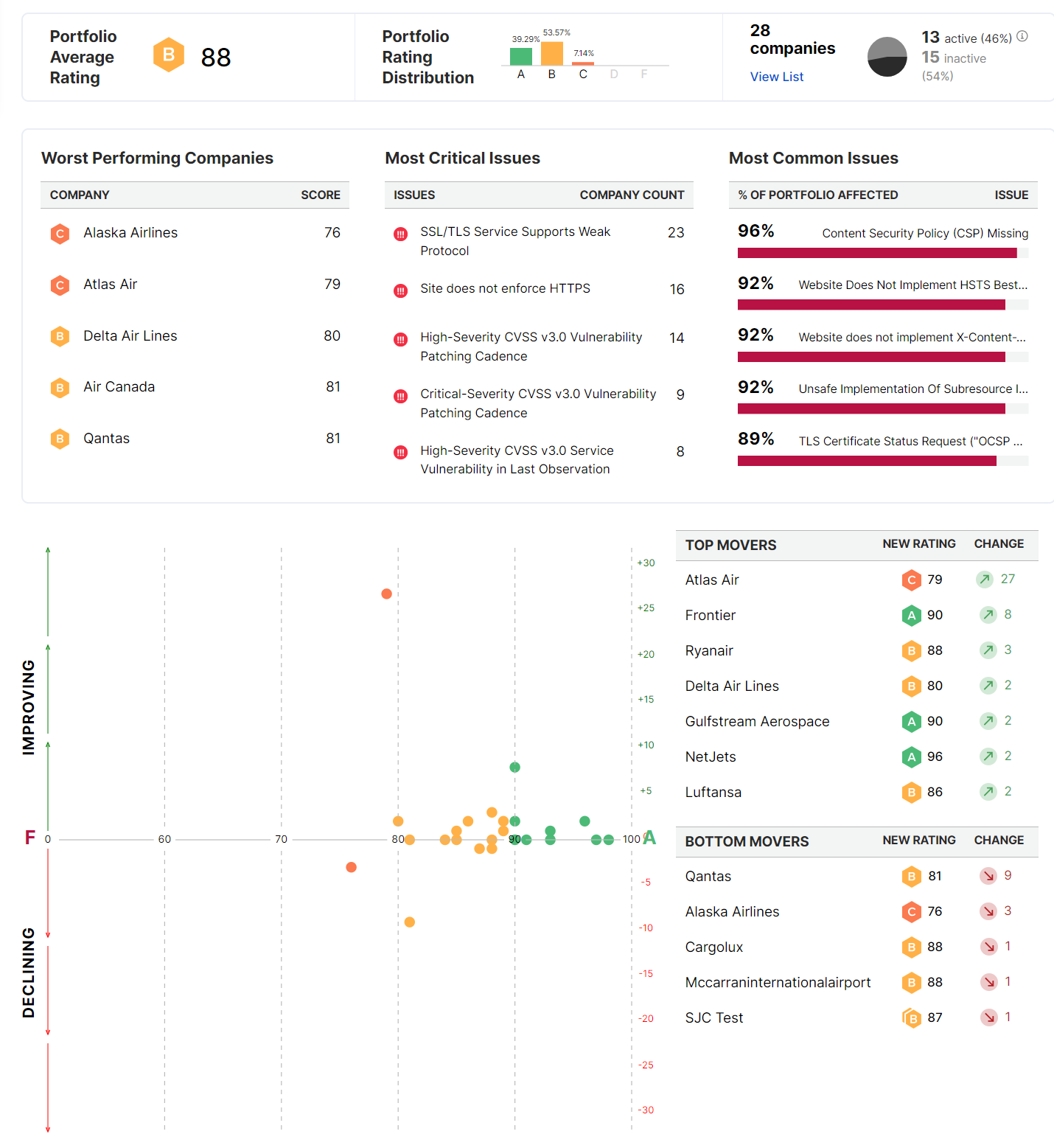

Effectively manage portfolio performance

Real-time data keeps you informed of new issues that could impact portfolio performance

Optimize your insurance portfolio to drive profitability and reduce risk

Cyber is a form of risk unlike any other insurable risk since it has no geographical bounds and is driven by a massive amount of invisible technology configurations and dependencies. Managing a cyber insurance book of business is challenging due to the vast amount of data that needs to be considered. SecurityScorecard reveals security trends and insights across portfolios to mitigate threats and create growth opportunities.

A View Inside

See the product itself

Outcomes

Drive profitability for the cyber book of business

-

Maintain a diversified portfolio

Verify adherence to underwriting guidelines and monitor risk accumulations to ensure that the business does not exceed risk appetites

-

Strengthen reinsurance relationships

Increase the reinsurance market’s trust in your risk management approach by demonstrating strong portfolio performance

-

Create growth levers

Capitalize on opportunities to expand the insurance portfolio, penetrate new markets, and introduce innovative products to address emerging risks and market needs

Critical Capabilities

-

Leading threat and risk telemetry

See more than you ever thought possible with the industry’s leading proprietary intelligence dataset

-

Continuous risk monitoring

Real-time data keeps you informed of new issues that could impact a portfolio’s profitability

-

Supply chain detection

Illuminate the tech stack of your insureds and their Nth party dependencies to identify concentration risks

-

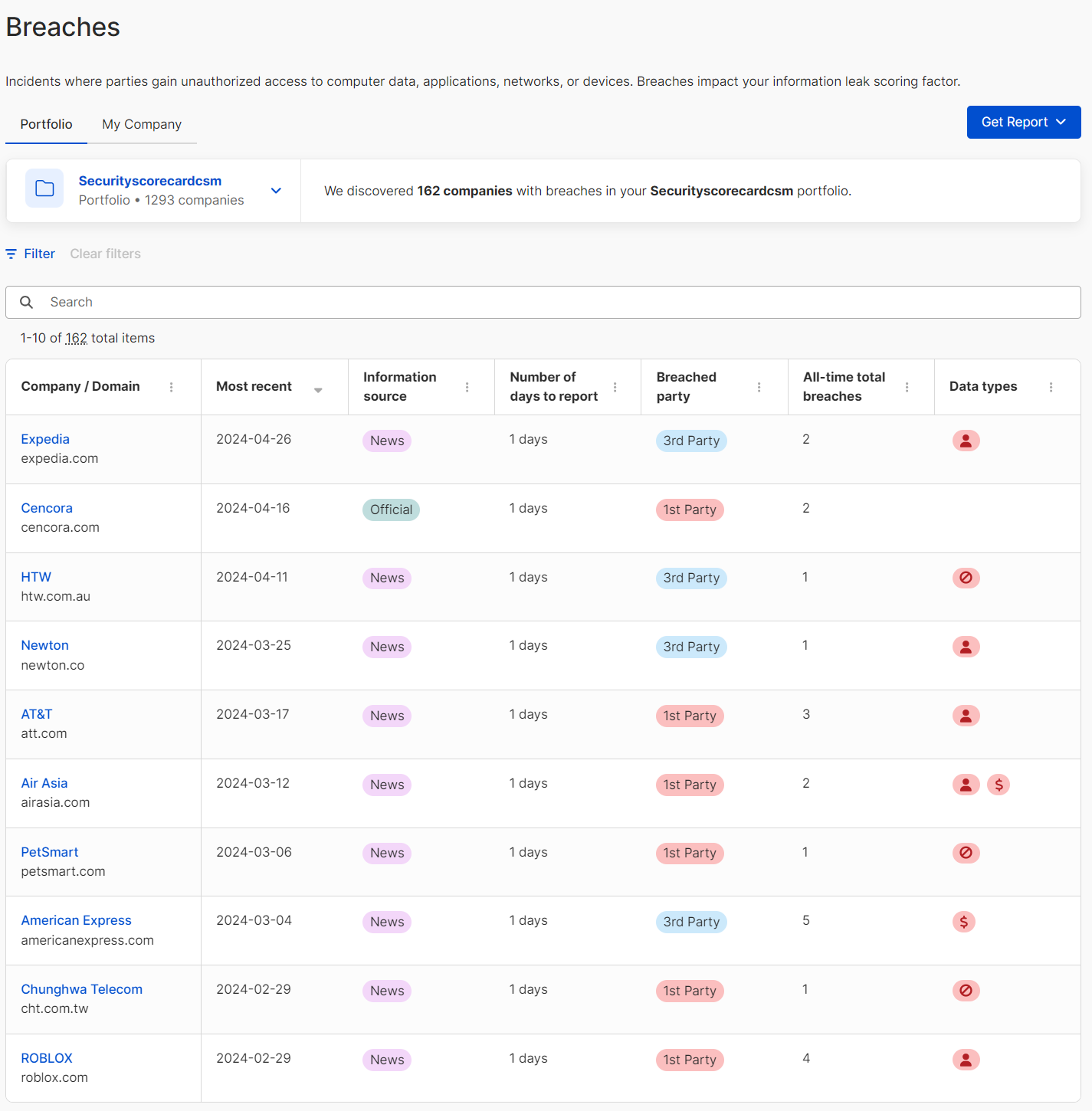

Rapid breach detection

AI-driven reconnaissance informs you of breaches as soon as they are publicly reported