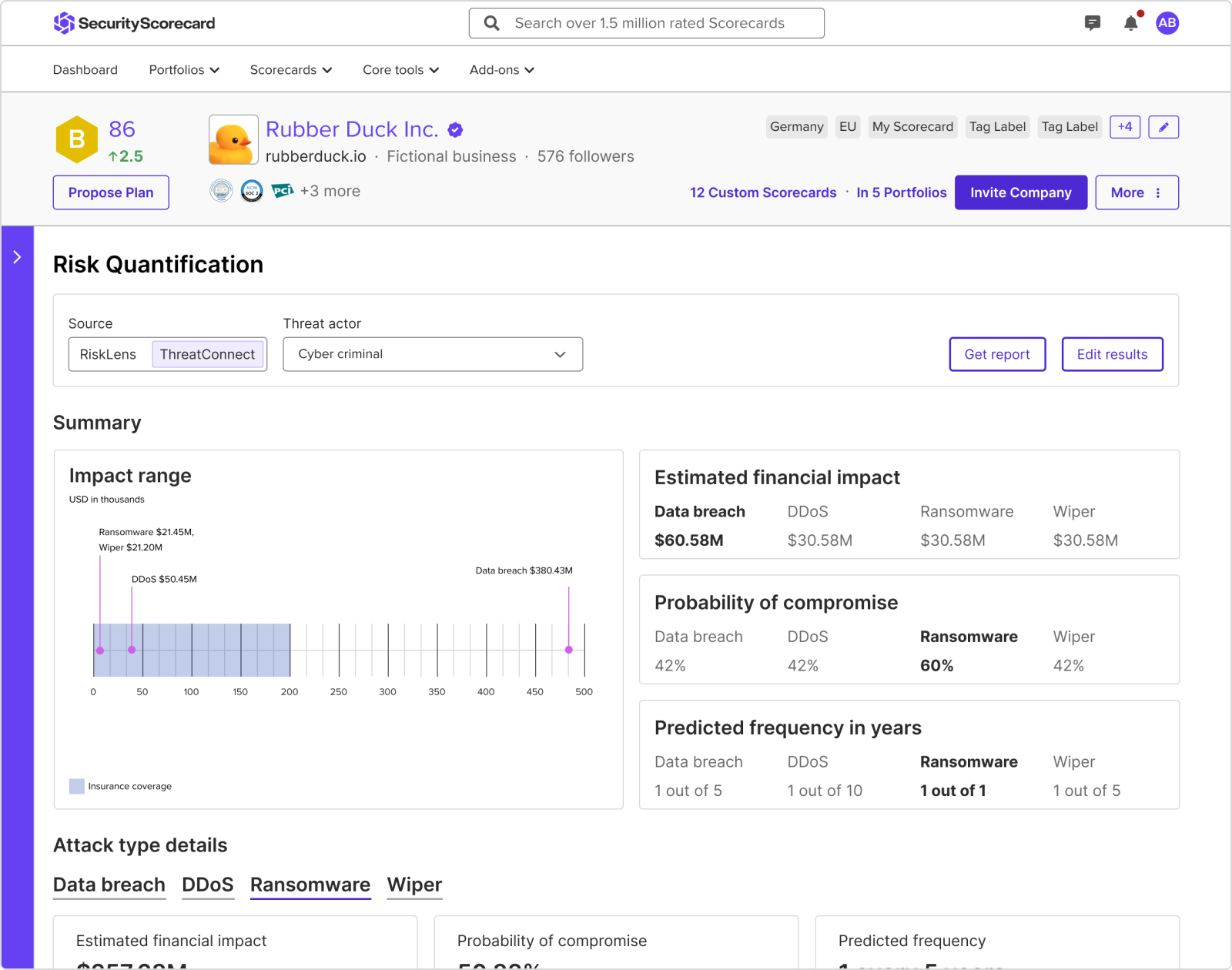

Determine the financial impact of cyber risk

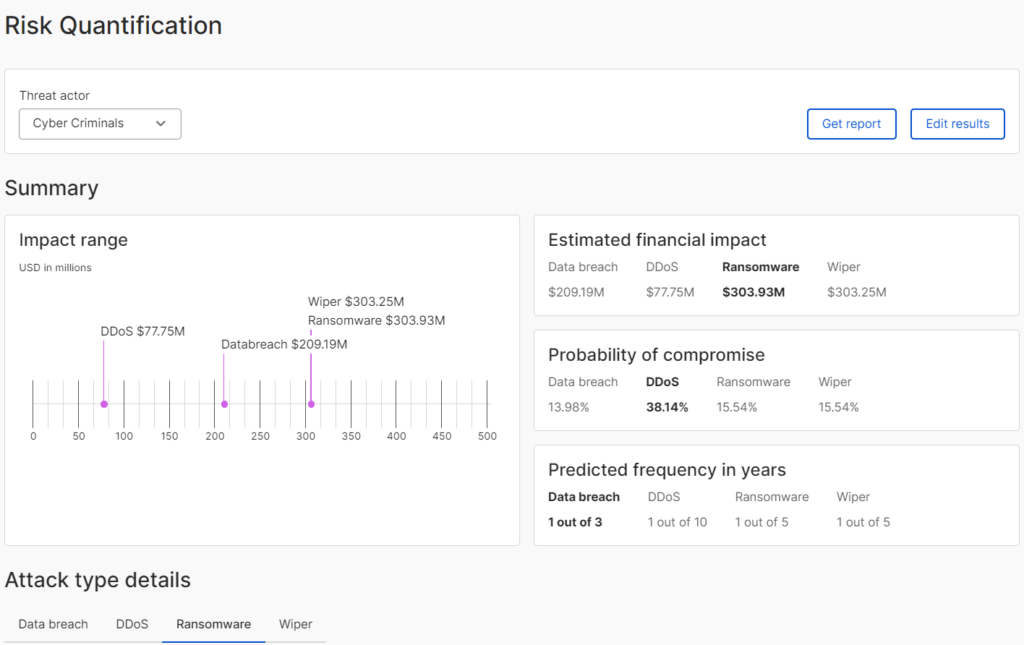

Leverage attack path modeling frameworks to estimate expected losses from a data breach, ransomware, denial of service, and destructive malware incidents.

Translate cyber risk into financial values

Premiums, coverage limits, and claims are the language of insurance, all of which are expressed in monetary terms. Many in the insurance industry often rely on models that only use firmographic data to assess financial impact. This approach does not take into account the security postures that drive claims, resulting in increased uncertainty and limited risk differentiation. SecurityScorecard’s Cyber Risk Quantification is powered by real-time cyber exposure data, enabling the insurance industry to accurately price cyber risk.

A View Inside

See the product itself

Key Features

-

ThreatConnect integration

SecurityScorecard ratings data informs risk modeling from ThreatConnect

-

Multiple loss scenarios

Evaluate impact of ransomware, data breaches, denial of service and destructive malware

-

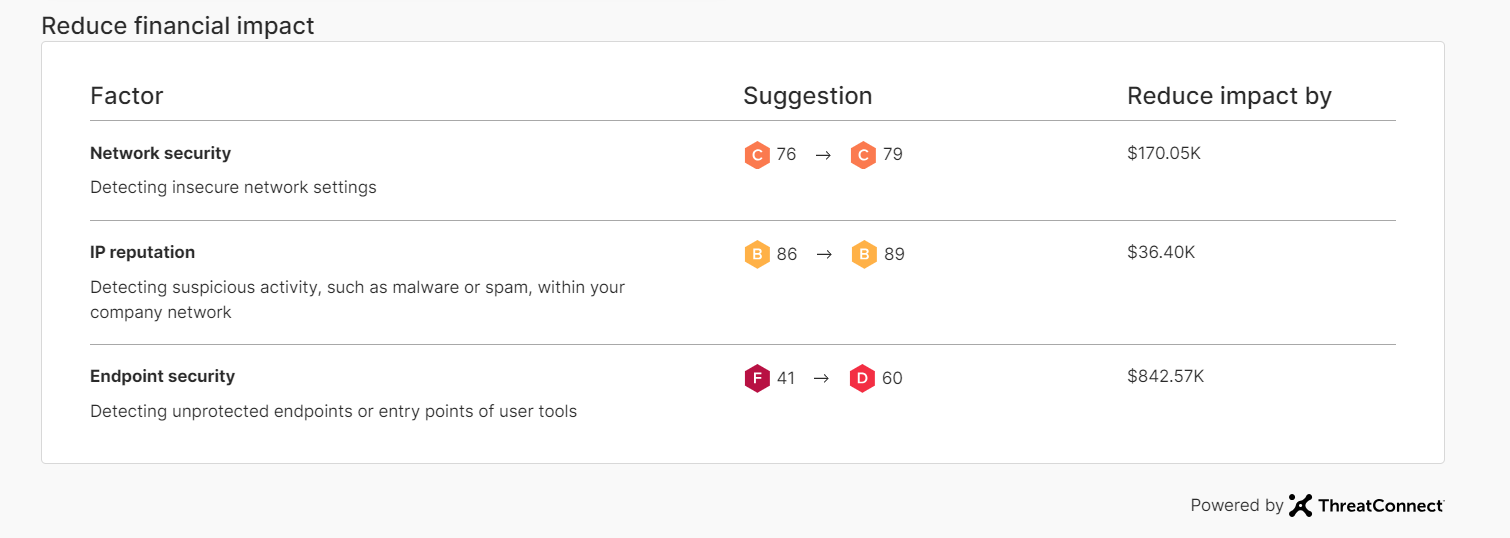

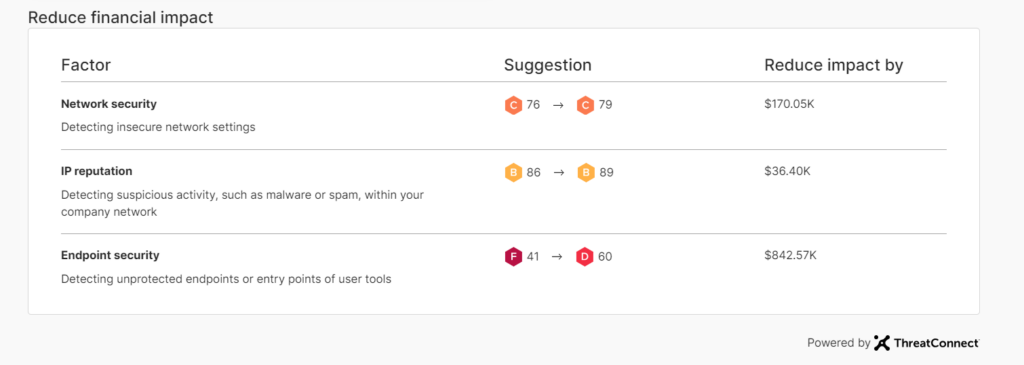

What if modeling

Quantify the reduction in expected losses if security improvements are made

Critical Capabilities

-

Understand risk profiles

Go beyond industry average analysis and gain actionable insights into the insured’s unique risk profile

-

MITRE framework mapping

Incorporate an assessment of defensive configurations against different threat actor tactics, techniques, and procedures

-

Ready-to-go model

Skip costly integrations and time-consuming model calibration and instantly receive analysis output