Capture the market and drive cyber insurance sales

Tailor client outreach with messaging to create compelling reasons to buy cyber insurance

Empower insurance producers and elevate outreach

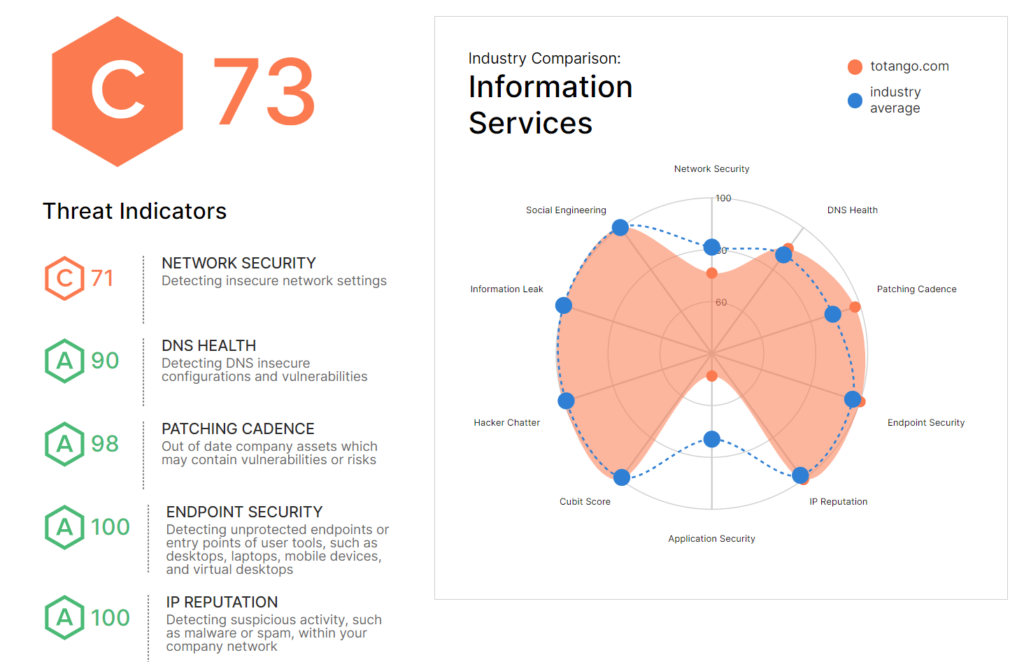

Brokers and underwriters agree that the biggest obstacle to selling cyber insurance is that insureds don’t understand their cyber risk exposure. Industry averages and other generic information are not enough to convince risk managers to consider cyber insurance. Using SecurityScorecard, producers can describe the likelihood and impact of cyber risk in terms that are intuitive and relatable, resulting in improved sales performance.

A View Inside

A look inside the product

Outcomes

Grow your book of business

-

Increase producer efficiency

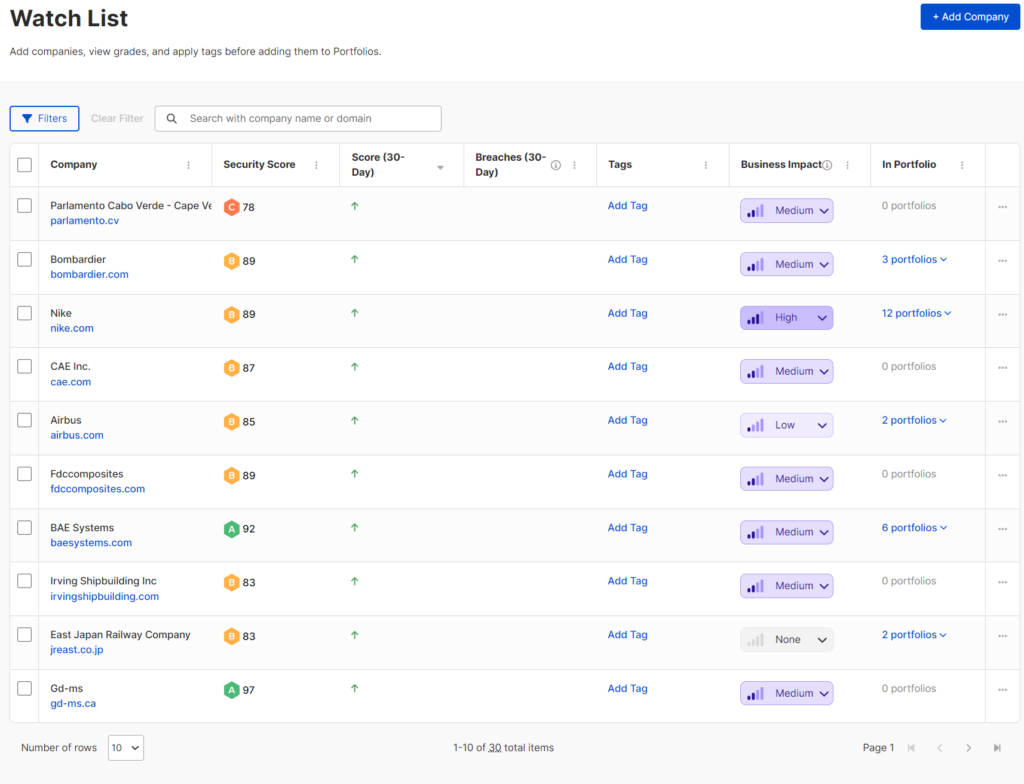

Acquire more clients from cold calling, networking referrals, and marketing campaigns

-

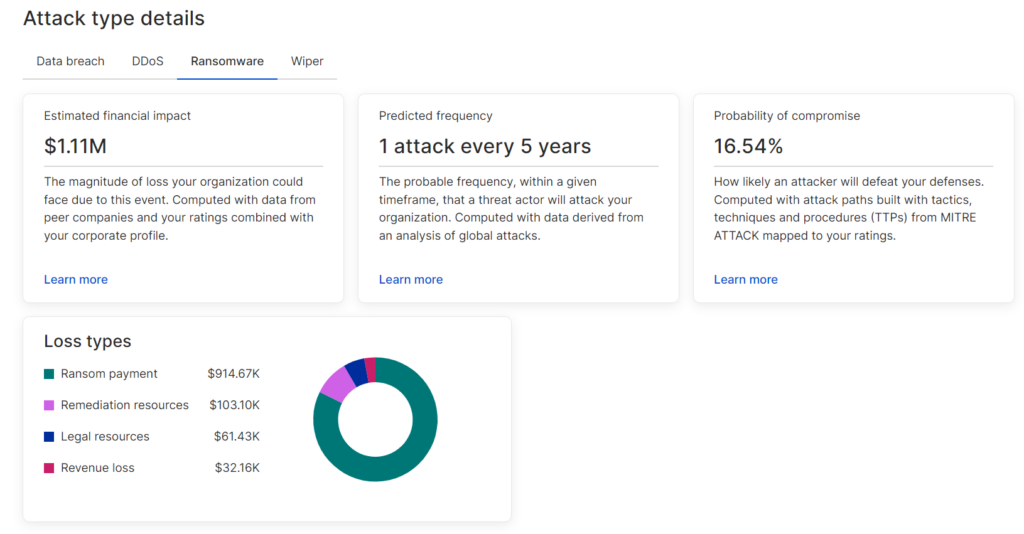

Create upsell opportunities

Identify clients with inadequate insurance coverage using estimates of their expected losses from cyber attacks

-

Improve client retention

Strategically position cyber insurance into existing programs and the brokerage’s cyber expertise as value-added benefits

Critical Capabilities

-

The most predictive security ratings

Harness the power of metrics that are highly correlated with breach frequency

-

Real-time risk analysis

Incorporate cyber risk insights specific to each account into client outreach

-

Continuous risk monitoring

Stay informed of new issues that could trigger a client’s interest in cyber insurance

-

AI-powered workflows

Leverage data correlated with claims to prioritize focus areas, enable automation, and drive action