Prevent cyber claims before they occur

Stay engaged with insureds and deliver timely risk management advice that prevents claims

Proactively manage loss ratios like never before

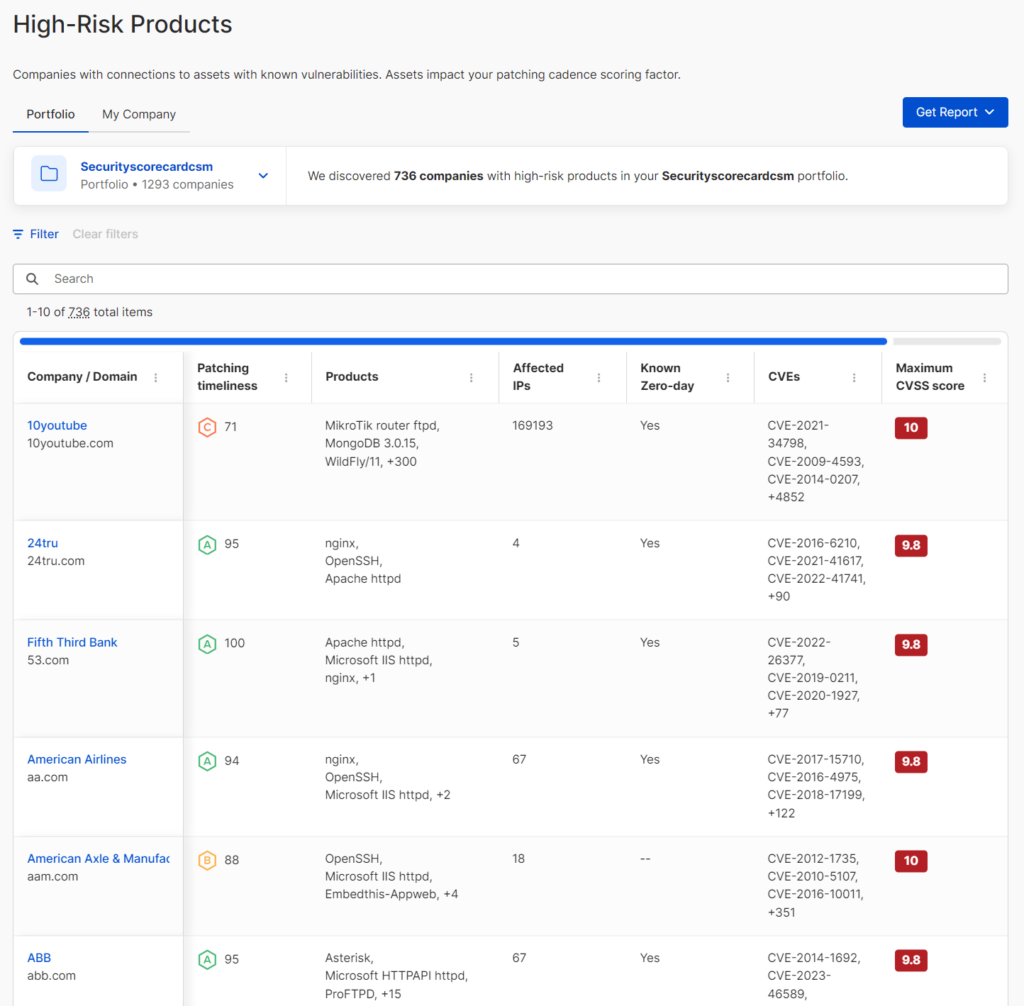

In cyber insurance, adequate pricing alone does not guarantee that premiums will cover future losses, as unforeseen risks can quickly arise after underwriting. An effective loss control strategy should be implemented to mitigate the unexpected and protect loss ratios. SecurityScorecard offers loss control leaders insights into active threats and workflows to remediate issues and prevent claims.

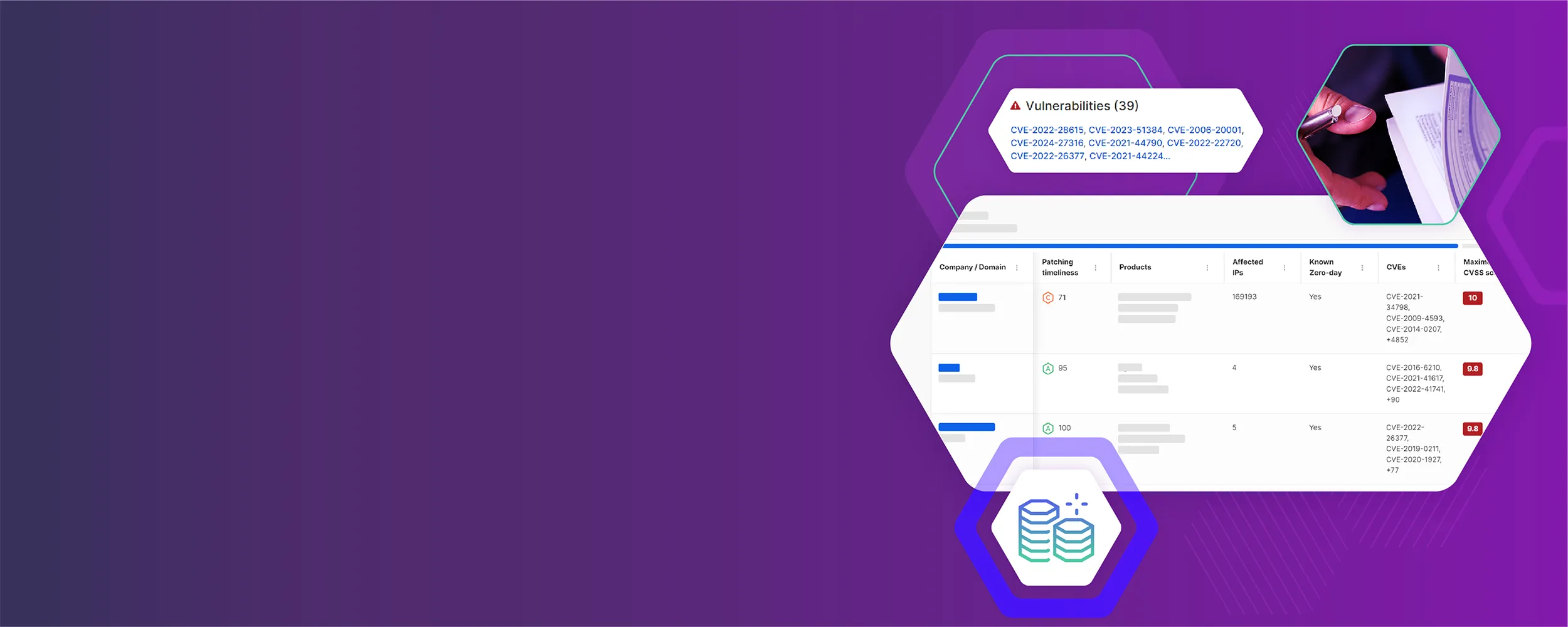

A View Inside

See the product in action

Outcomes

Establish a line of defense from dynamic cyber risks

-

Lower loss ratios

Increase the resilience of policyholders during the policy term to drive down claims frequency and severity

-

Increase policyholder retention

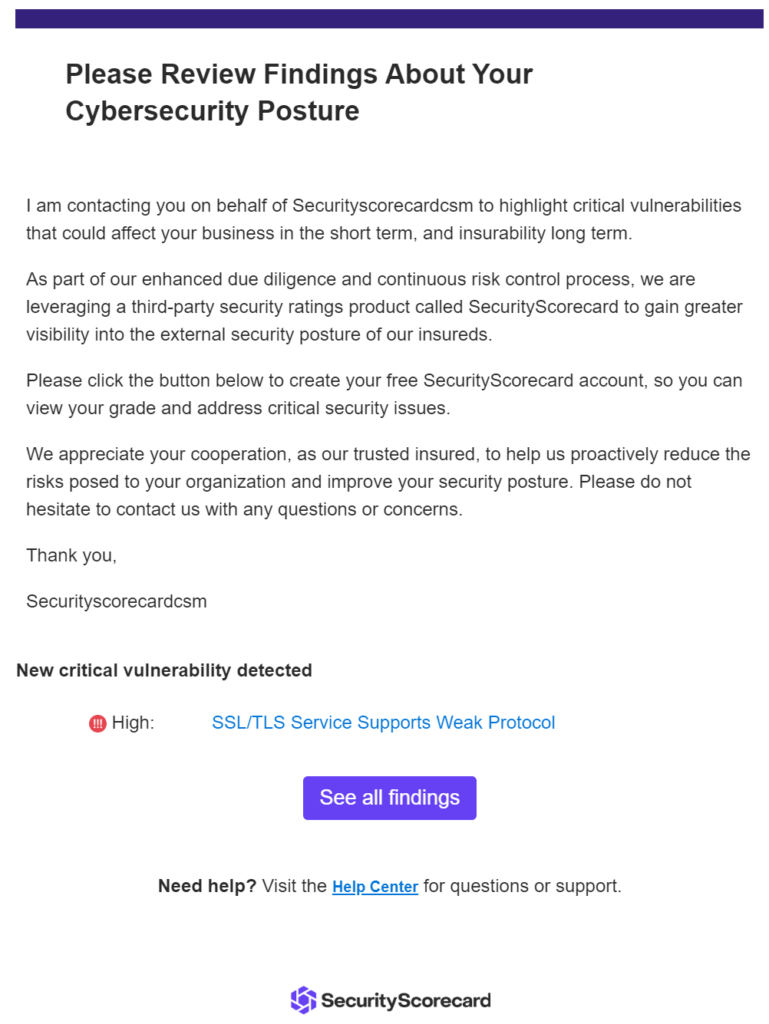

Deliver value-added services that increase engagement with policyholders and promote a culture of security

-

Create loss control efficiencies

Reduce the time and effort to manage loss control programs by leveraging workflow automation

Critical Capabilities

-

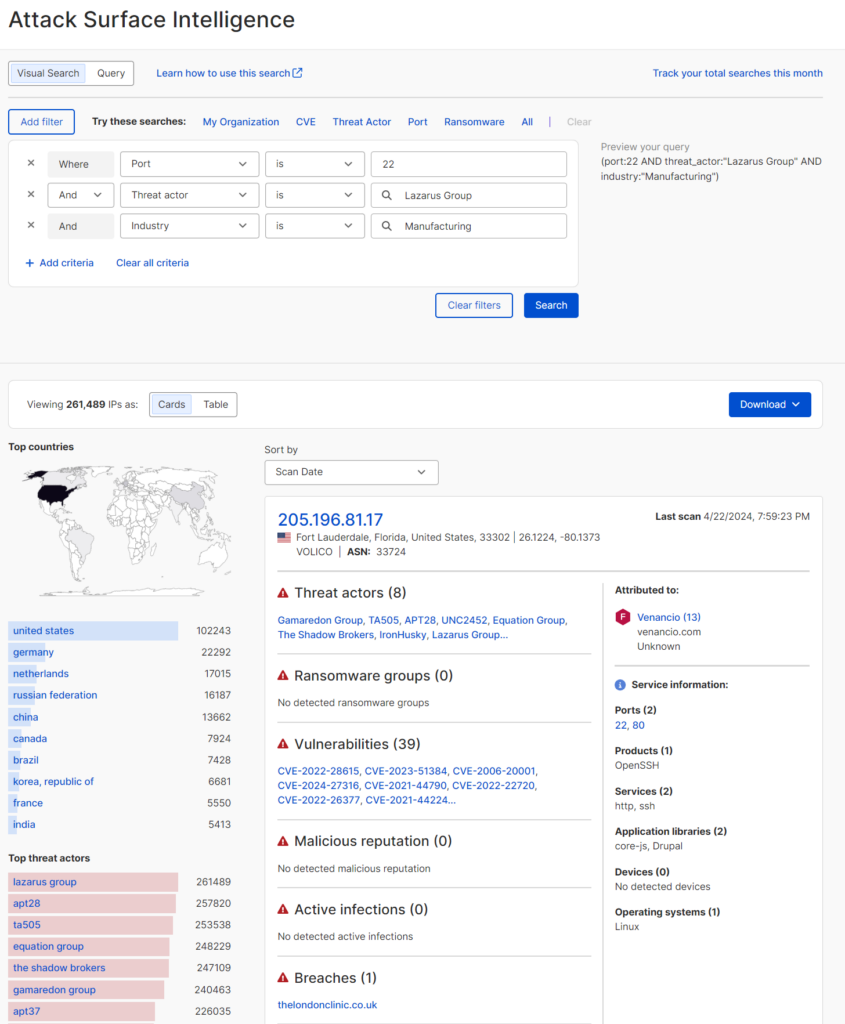

Threat actor reconnaissance

Leverage intelligence gathered from over 200 sources across the dark web and keep a close eye on critical assets

-

Global sinkhole network

Identify malware and malicious infrastructure to determine which insureds show signs of compromise

-

AI-powered workflows

Leverage data correlated with claims to prioritize focus areas, enable automation, and drive action

-

Expert resilience services

Partner with cyber experts to defend, respond, and fortify your insured’s security program