-

Manage cyber risk across your portfolio

Identify, measure, and resolve cyber threats with AI-powered cyber risk management. Drive cyber risk insurability.

Trusted by the best insurance partners in the world

Why SecurityScorecard?

Security ratings are vital to regulators, insurance providers, governments, and companies. SecurityScorecard offers continuous monitoring and real-time insights, helping insurance providers assess and manage cyber risks effectively. Our robust analytics and automated alerts also aid in proactive risk mitigation, minimizing the likelihood of claims due to cyber incidents and supporting better cyber insurability.

-

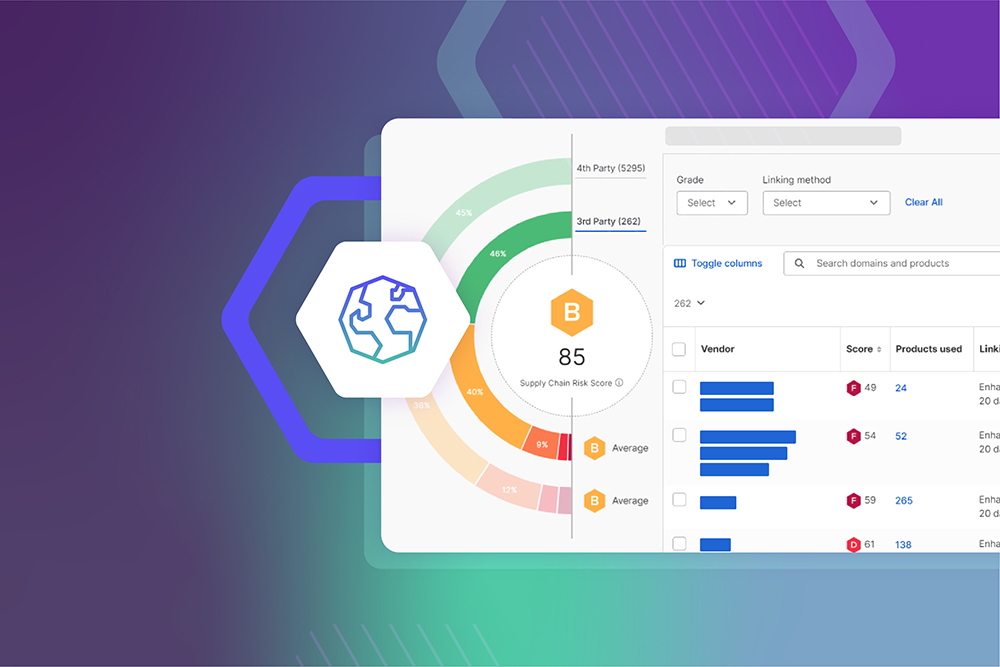

Comprehensive data collection provides continuous visibility of cyber risk exposure

-

Common platform for insureds, brokers, and underwriters drives transparency and efficiency

-

Industry-leading expertise in preparing for and responding to cyber incidents

SecurityScorecard reduces third-party breaches by 75%

SecurityScorecard’s platform is trusted by top companies across various industries for its accuracy, transparency, and comprehensive data, making it the leading solution for managing cyber insurance risks.

-

Marsh McLennan and SecurityScorecard collaborate to identify security factors predictive of a breach.

-

“Security ratings give you a dynamic point in time view of cybersecurity posture.”

Nimisha Aneja, Senior, Underwriter, RSUI

-

“We are integrating with SecurityScorecard to help clients understand their cyber risk exposure.”

Claudia Piccirilli, Global FINEX Head of Data Science and Analytics, WTW

Solutions for cyber insurability

SecurityScorecard offers a suite of solutions specifically designed to assess and improve cyber insurability, helping insurers make informed underwriting decisions while assisting insureds in meeting security requirements.

Products and Services

SecurityScorecard offers an extensive portfolio of products and services to help organizations and insurers assess, manage, and reduce cybersecurity risks.

-

Scoring and Attack Surface Scanning

Instantly evaluate the cyber risk exposure for any organization

-

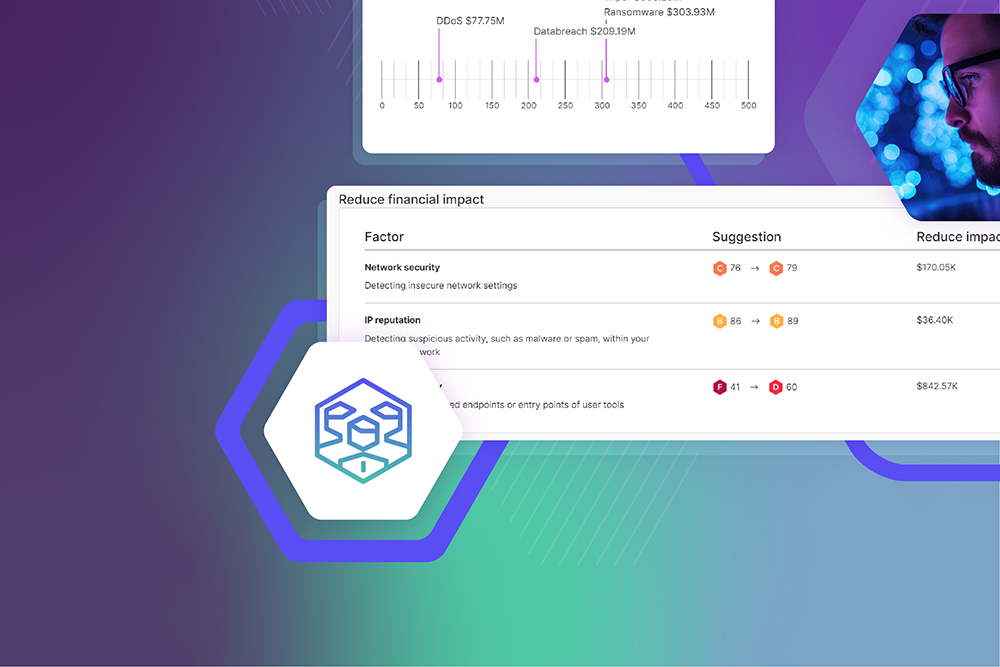

Cyber Risk Quantification

Determine the financial impact of cyber risk for any organization

-

Threat and Vulnerability Intelligence

Identify the threats that put insureds at risk

-

Policyholder Services

Reduce insured risk before and after incidents occur

FAQs

What is cyber insurance?

Cyber insurance, also known as cybersecurity insurance, is a type of coverage designed to protect businesses and individuals from financial losses due to cyber-related incidents, such as data breaches, cyberattacks, ransomware attacks, business interruption, legal and regulatory costs, third-party liability, and cyber extortion.

It helps mitigate the financial impact of these threats, offering businesses the ability to recover more quickly from security incidents while managing compliance and reputational risks.

What does a typical cyber insurance policy cover?

It addresses both first-party and third-party risks and covers expenses related to data breaches, network security coverage, legal counsel, forensic investigations, and ransomware payments. It can also include coverage for business interruption, loss of revenue, and privacy violations.

Why should business owners consider cybersecurity insurance?

Business owners should consider it because it safeguards against potential financial losses, legal liabilities, and reputational damage caused by cybersecurity incidents.

How do insurance companies assess risk for cyber policies?

They evaluate several key factors, such as the organization’s security measures, past cyber incidents, and industry-specific risks, to determine premiums and coverage. The industry a company operates in is also a consideration, along with company size, data sensitivity and volume, claims history, and compliance with regulations.

Does cyber insurance cover financial losses from business interruption?

Yes, many policies include coverage for business interruption, compensating for loss of revenue, and operational downtime due to a cybersecurity incident.

Can cyber insurance providers help with forensic investigations?

Yes, cybersecurity insurance providers often offer support for forensic investigations. This coverage helps businesses hire cybersecurity experts to investigate the cause, scope, and impact of a cyber incident. Forensic teams identify vulnerabilities, assess data breaches, and help restore systems, aiding in both recovery and prevention of future attacks.

What should businesses look for in a cyber attack insurance policy?

Businesses should ensure the policy covers network security, data breaches, legal expenses, and provides support for ransomware payments and business interruption. Other key factors to consider include first-party and third-party coverage, policy limits and deductibles, incident response services, exclusions, regulatory coverage, reputation management, and vendor and supply chain coverage.