Make smarter underwriting decisions

Instantly gain an accurate picture of any insured’s security posture to supplement application data

Never sacrifice due diligence for growth

Insurance applications will never be able to capture all the data necessary to understand an organization’s cybersecurity risk. Underwriters that only evaluate applications are effectively flying blind and putting themselves at risk of providing coverage that a competitor would not. SecurityScorecard empowers underwriters to quickly identify the most profitable opportunities with accurate insights about an insured’s security posture.

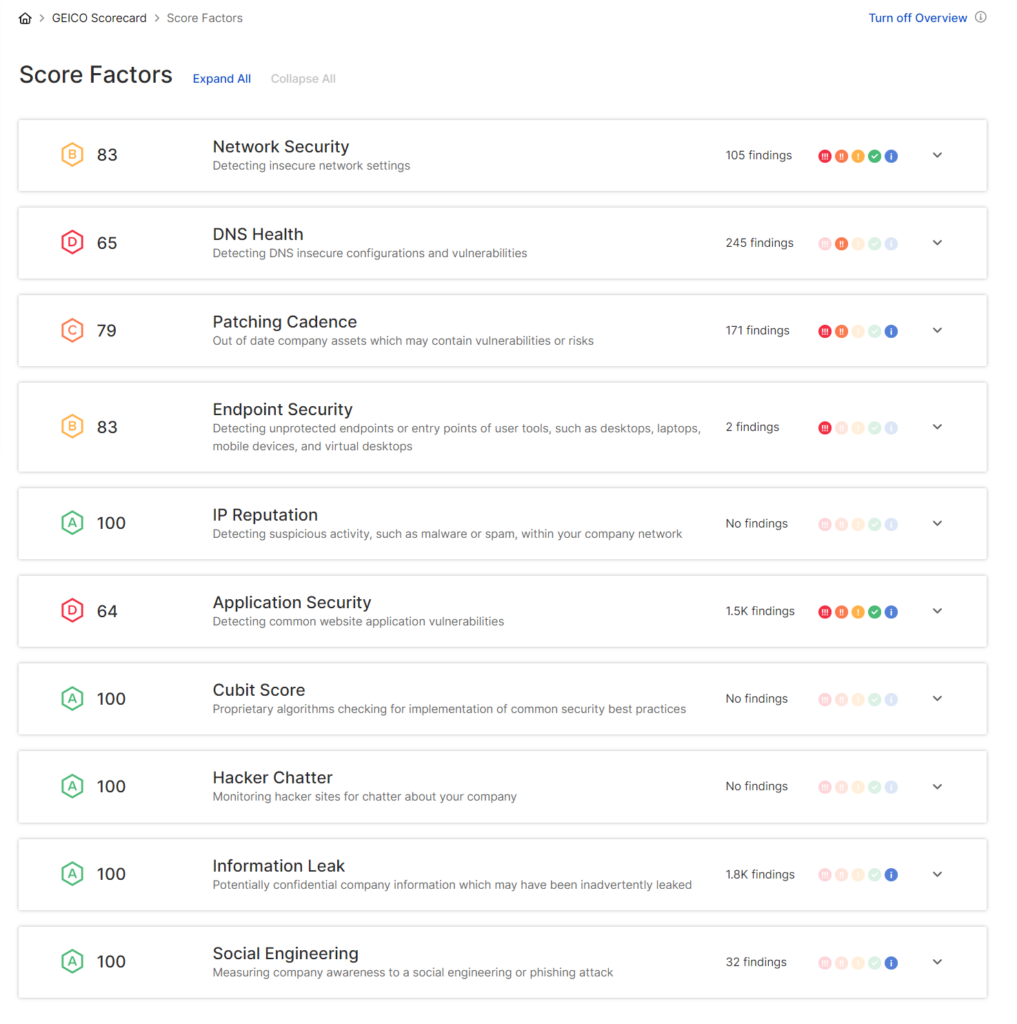

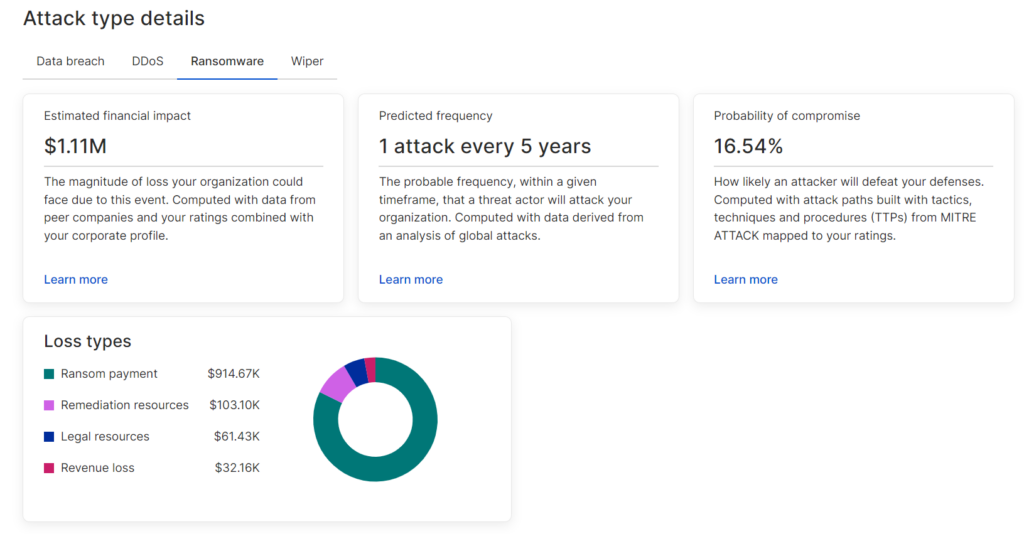

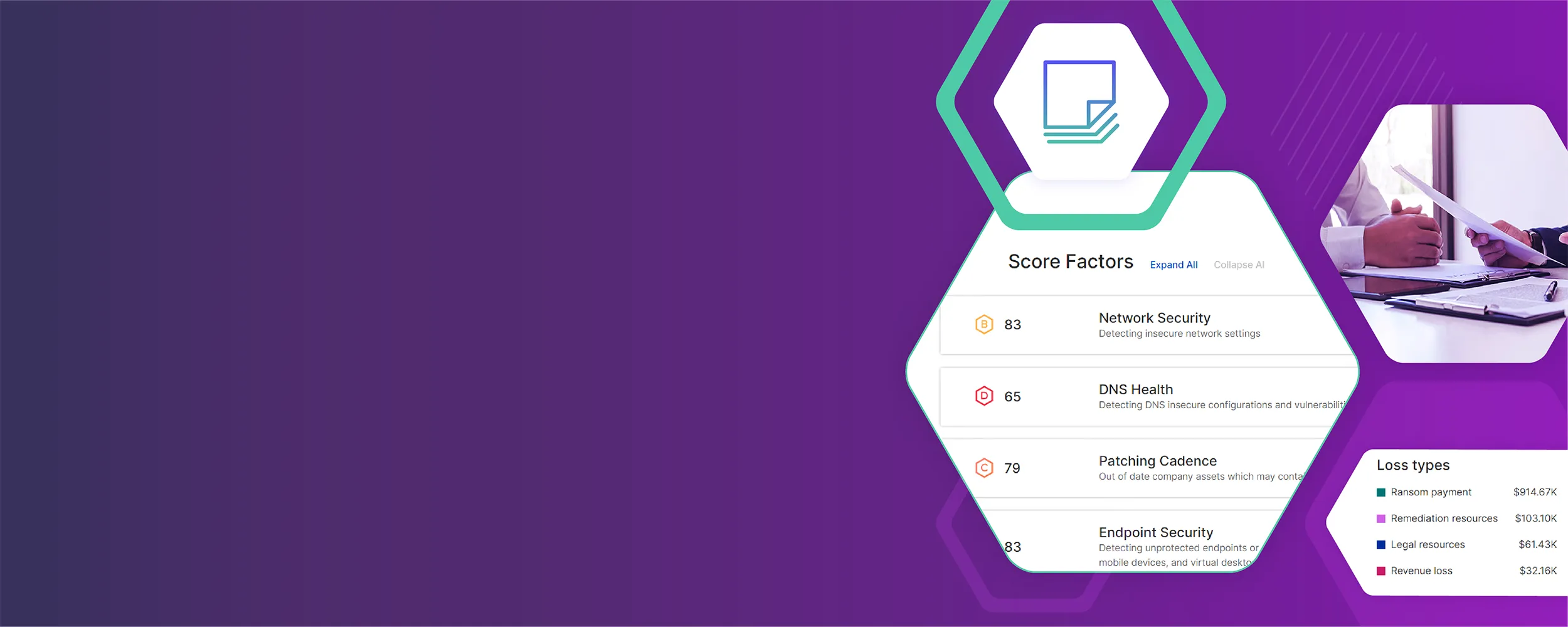

A View Inside

See the product itself

Outcomes

Master the art and science of underwriting

-

Improve loss ratios

Avoid adverse risk selection by identifying the insured’s that consistently demonstrate strong security practices

-

Create underwriting efficiencies

Spend less time evaluating unprofitable risks, make faster underwriting decisions, and achieve faster alignment with brokers on next steps

-

Incentivize resiliency

Reward insureds with strong security posture with premium and coverage perks that are tied to actionable security metrics

Critical Capabilities

-

The most predictive security ratings

Harness the power of metrics that are highly correlated with breach frequency

-

Real-time risk analysis

Incorporate cyber risk insights specific to each account into outreach without delaying client engagement

-

AI-powered workflows

Data correlated with claims prioritizes areas of focus, enables automation, and drives action

-

Attack surface visibility

Accurate view of an insured’s attack surface, indicators of compromise and threat actors activity